There are many options types, strategies, and buy and sell combinations. By mixing them, or just choosing several conservative ones, investors can take a step into potentially higher returns, with a limited loss potential (NB: deep reading into options types and strategies and types is essential in order not only to trade, but to avoid losing more than the invested amount).

Another similar option can be investments into leveraged ETFs (exchange traded funds). ETFs can be the best of both worlds in terms of risk: they are typically internally diversified (investments are spread throughout many businesses), while at the same focusing on capturing or repeating singular performances (such as of sectors or indices).

A leveraged ETF seeks to not only to repeat or capture the same singular performance of a certain financial area, but also to double or even triple it. Hence, the double or triple leveraged ETFs.

Let’s see how a correct guess by an investor that during the 2015-2020 period the United States economy was bound to an upward path, would have brought a higher, but limited risk profile with leveraged ETFs. Also, at the same far higher returns than the lower risk investment – unleveraged ETF.

The S&P 500® serves as the baseline index for all investments.

In the graph above, three ETFs representing the index are shown. The unleveraged ETF is in orange (VOO), double leveraged in black (SSO), and triple leveraged in blue (UPRA).

Two extremes at the start of 2020 are important. The triple leveraged ETF outperformed its closest competitor by over 50 percentage points in its highest high. It also reached the lowest low out of three ETFs following the same index.

After a bounce back, in the end of 2020, the triple leveraged ETF yet again reached the highest final gain of over 200% from the chosen starting point in 2015. At the same time, the unleveraged ETF, while managing to avoid the around -20% return, delivered still a large, but not as obnoxious change of over 75%.

The investor in this case could have profited by following a fairly long investment time period, and by having the financial and psychological abilities to cope with the extreme losses by leverage. In turn, with a limited risk (the size of the investment), very high returns would have been reaped.

Real estate crowdfunding (Real estate crowdfunding pros and cons. Profit from real estate crowdfunding) is another higher risk investment that may present a good avenue for investors seeking higher returns. The returns vary, but can reach up to 11%-13% yearly, and present an investment into an asset class that is sought by many.

The returns and the changing, but unending demand by the consumers, makes real estate crowdfunding an attractive prospect. Especially, during times when inflation can decimate lower return investments.

However, caution still must be exercised. Unstable times mean that previously unexpected outcomes can emerge. Instability in the economy also brings instability into people’s wallets, and that may translate into lower demand and paying ability for this asset class.

Decided to try real estate crowdfunding?

Particularly, real estate crowdfunding in Europe?

Use this referral link (click here) and the code “EGU71521” to get a 0.5% bonus from the invested sum!

Note: the owner of the link may also receive a bonus, at no additional cost to the investor.

Catastrophic economic events and risk

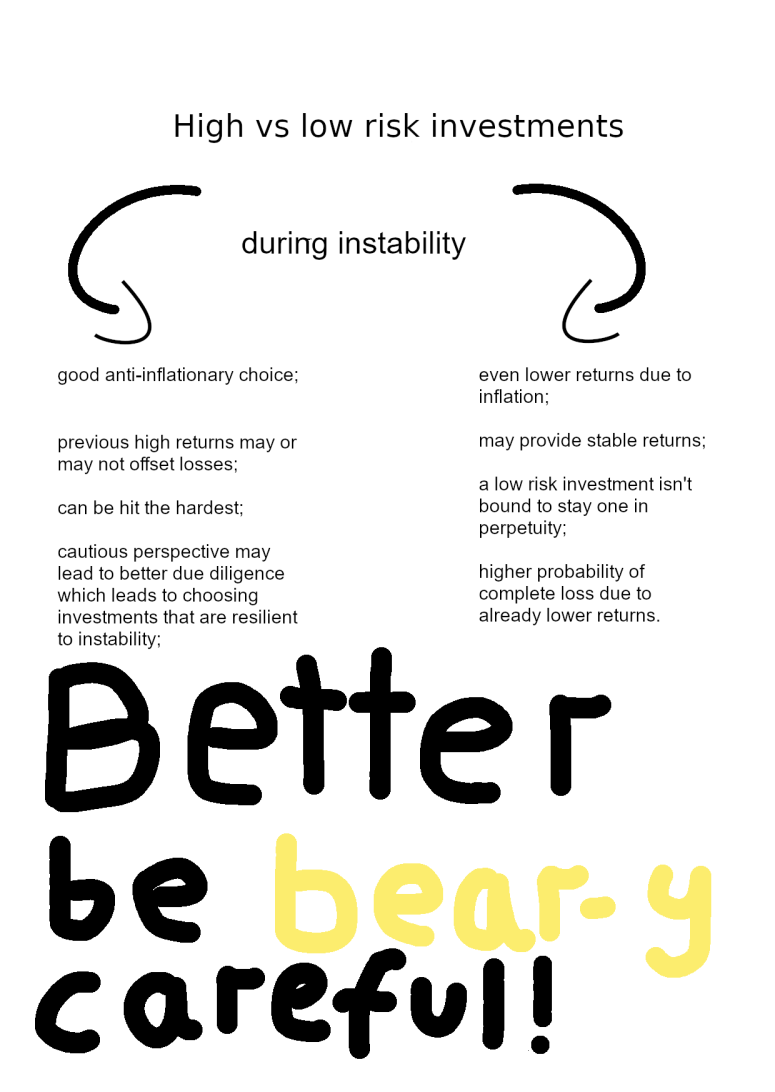

As other types of investments, high risk investments are also subject to the effects of the most severe negative economic events.

The tie between the worldwide or regional states of economy and high risk investments is most visible during difficult times. The negative effects of upheavals can be mitigated or even used to growth wealth (

Financial preparation for a catastrophe: personal and business). However, unless carefully planned, economic upheavals tend to lead to lower returns on investment for high risk investments.

One of the most accurate examples of this has been the 2008 financial crash. Unless intelligence gathering on the borrowing trends was done, many investors lost a lot of their high risk investments.

Forex investors saw losses when countries did not cope well with their internal economic turmoils. Many options investors would have had seen large losses with unrelated businesses going down under. Both personal and real estate lending investors, direct and not, were hit especially hard when the crash happened.

Risk mitigation

High risk investments may seem to come with an inherent and uncontrollable risk for investors. Yet, the risk of receiving lower returns, or losing the invested money altogether can be mitigated with several tools and strategies.

The most important strategy is to widen the time horizon both for the investment, and the expected exit date. This means choosing investments that both a) run for a longer time and b) the investor is comfortable with holding for a longer time than usual.

In practice this would lead to looking for longer investments divided into smaller parts (e.g. 48 month real estate loan with interest paid every other month). The investor would also have to be comfortable financially and psychologically with a loss in the short-term. A later exit then would have, all other things being equal, a higher probability of bringing profit (of course, if the investment already is high quality, and under performs solely because of the chosen time frame).

Who wins the race

Investing and not gambling is essential. Even the highest risk investments may offer consistent returns to a minuscule share of investors. Yet, there are great many reasons why those investments are not so popular. Due diligence and investor’s own realistic risk assessment can guide to the winning moves.

Disclaimer: this article is not intended to be taken as investing advice. All losses or profits are the sole responsibility of the investors.